Marrello Capital Management

We focus on identifying and profiting from structurally inefficient pockets of the stock market where the shares of some companies can be bought for much less than their intrinsic value.

Our firm takes concentrated, long-term positions in high-quality yet misunderstood businesses that have robust competitive advantages and generate strong free cash flow. We also occasionally increase our returns through event-driven investment opportunities.

The Opportunity

Over the past few decades, passive “index investing” has become ever more commonplace, pushing up valuations of S&P 500 stocks while leaving many other companies unfollowed and undervalued.

We take advantage of this by identifying and becoming intimately familiar with promising smaller companies, investing only in those few that offer the highest long-term return potential and the best risk/reward tradeoff.

Being a small firm allows us to invest in pockets of the market that larger firms cannot, where we find and profit from disparities between companies’ long-term value and current market price.

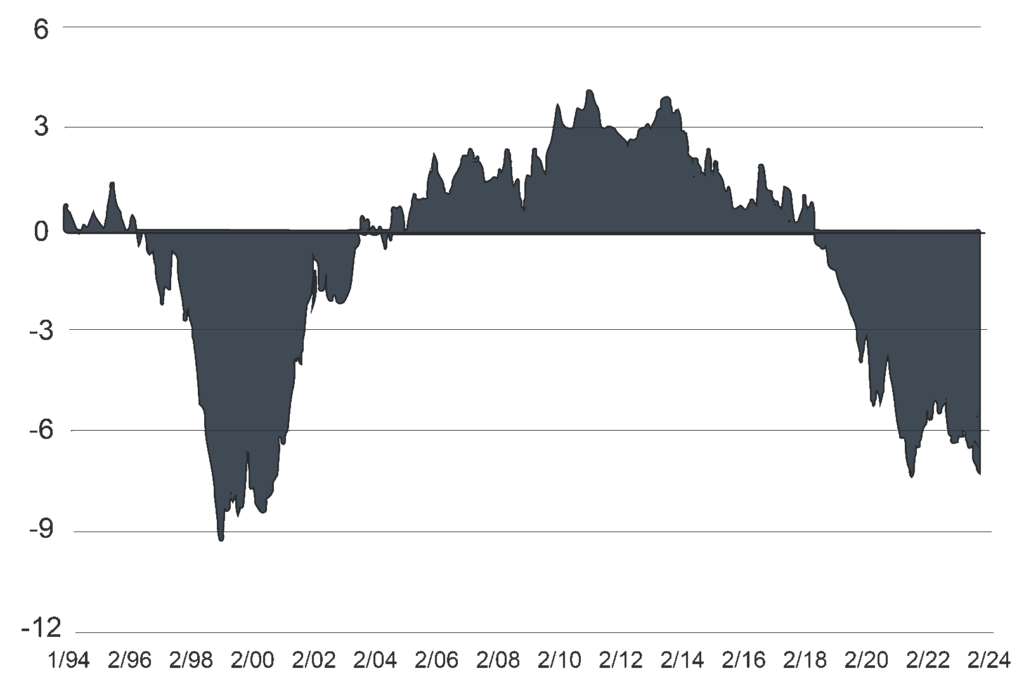

Small-cap stocks have not been this undervalued relative to large caps since the dot-com bubble

Forward P/E premium/discount (S&P 600 vs. S&P 500)

Investment Strategy, Overview

The Fund’s core investing strategy involves finding investment opportunities that the market has overlooked or just doesn’t understand. We select our core investments based on each company’s fundamentals and current valuation, and we also look for future catalysts that can unlock shareholder value.

Occasionally, we also make event-driven investments, seeking to exploit pricing inefficiencies that may arise from corporate events such as mergers and acquisitions, spin-off divestitures, and asset liquidations.

Core Investment Strategy

We seek asymmetry in each of our core investments: a margin of safety coupled with extreme return potential. Specifically, we invest in companies that:

- We can purchase at a material discount to intrinsic value

- That the market has misunderstood and/or overlooked

- Have a future catalyst that should unlock the company’s intrinsic value

We take great care in selecting core investments that can deliver outsized returns with low risks over extended time horizons. This long-term focus is the key to maximizing portfolio returns.

Investment Philosophy

With the occasional exception of some of our event-driven investments, we always invest according to these core principles:

We always prioritize downside protection over other investment factors

The highest returns come from owning shares in 8 to 12 great companies, which allows us to intimately know each company

and its industry context

and its industry context

We understand that undervalued companies need time to reach their full potential and valuation, and that diligent and patient investors ultimately perform much better than their peers

One or two great investments often drive most of a concentrated portfolio’s returns; we do not invest in any company lacking

the potential to be one of these great investments

the potential to be one of these great investments

We focus only on inefficient market segments

where mispriced securities are abundant

where mispriced securities are abundant

Risk Management

We define risk as the potential for permanent capital loss, not as stock price volatility.

To mitigate the risk of permanent capital loss, we:

- Perform an exhaustive analysis of each company and its industry before investing in it

- Only invest when we have an adequate margin of safety

- Occasionally employ leverage, but only sparingly and conservatively

- Avoid short selling and the use of derivatives

Leadership

Dylan Murray, Principal

Dylan oversees all investment management and operational functions for the firm. With a strong background in investing and financial analysis, he is in charge of executing the firm’s investment strategy.

In addition to his long personal experience investing according to the firm’s investment philosophy and strategy, he also publishes an investment newsletter that has over 1,000 subscribers. In this newsletter Dylan explains his analyses of various investment opportunities in detail, providing his insights to his subscribers.

Dylan previously worked as a litigator for Kirkland & Ellis and Bennett Jones as served as a Judicial Law Clerk in the B.C. Court of Appeals. He holds a B.A. in Economics from McGill University and a J.D. from the University of Toronto.